The unitisation agreement

Signed by the Norwegian and British governments on 10 May 1976, this unitisation agreement marked an important breakthrough in international law. Two countries had agreed for the first time on how they were to exploit an offshore petroleum deposit as a single unit, with joint installations on both sides of the boundary.

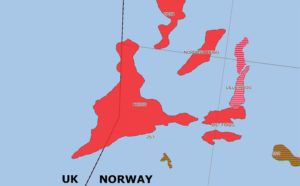

The Frigg reservoir straddles the UK-Norwegian median line in the North Sea, with the Total Oil Marine (TOM) group operated by Total on the British side and the Petronord consortium with Elf as operator on the Norwegian. A number of considerations had to be clarified before a development of the field could begin.

First, the two sides had to decide whether Frigg should be developed as a unit, or as two separate parts. The size of the field and its division between the two nations also had to be clarified. Last but not least, a decision had to be taken on where the gas should be landed and sold. Once the licensees had reached agreement, too, their decisions had to secure UK and Norwegian government approval.

Negotiations on the Frigg development became a touchstone for cross-national exploitation of a petroleum field to the benefit of society. Socio-economic and resource considerations favoured a unitisation. The licensees needed to join forces on a common plan for development and operation, and reach agreement on how costs and revenues should be allocated in relation to licence interests. But unitisation calls for collaboration between licensees who do not necessarily share the same interests. This proved to be the case on Frigg.

Tildeling av blokk 10/1 på britiske side, historie, forsidebilde, , kart,

Tildeling av blokk 10/1 på britiske side, historie, forsidebilde, , kart,A series of smaller agreements concluded between Petronord and the TOM group in 1973 and 1974 formed the basis for the unitisation deal. To understand something of the complexity of the main accord, it is necessary to look at these underlying agreements.

Norwegian concerns

Efforts to reach a unitisation agreement dragged on. After the discovery of Frigg in 1971, discussions began on how to develop the field. The various parties agreed that its exploitation called for collaboration, but not on how extensive this should be. Norsk Hydro stood at one extreme, calling for full unitisation with joint development, production, transport and sales, while both the Norwegian government’s oil office and Elf believed that unitisation had to cover production from the reservoir but did not necessarily have to extend to development, transport or sales. Total and Aquitaine were on the other side, and their sole interest was getting going as quickly as possible. The British government also wanted the fastest possible development so that Frigg output could help relieve gas supply shortages in the UK during the early 1970s.[REMOVE]Fotnote: Since the Ekofisk gas had gone to Germany, securing Frigg production was important for the British Gas Corporation (BGC). It made no secret of its desire to obtain the Norwegian share of the field’s gas. The British gas market would have a supply deficit from 1975, with demand expected to rise from roughly 40 billion cubic metres in that year to about double this level by 1982. Total wanted to act while the terms were good. Possible further major gas discoveries in the North Sea would change sales conditions. The consideration for the Norwegian government and Hydro was not so much time but more the attainment of full unitisation, so that the field could be jointly developed and operated.

Norway was very concerned that Total would begin production from the UK part of Frigg before Petronord was ready to start on the Norwegian side. This reflected a recognition that whoever was first to get going could tap the whole reservoir. Production would cause pressure changes affecting other parts of the field, with gas being drawn towards the producing wells regardless of national boundaries. The Frigg field was very homogenous and permeable, making it impossible to separate Norwegian from British gas during production.

Elf, the operator for Norway’s share, was less concerned than its Norwegian partners. It had almost 45 per cent of the TOM group, and would receive revenues wherever the gas came up. The three French companies in Petronord’ Elf, Total and Aquitaine – were the sole licensees for the British share, and would accordingly make money regardless of where production started. Since taxes were lower on the UK continental shelf, early production there would actually be an advantage.

The Norwegian companies and authorities had to stand together to achieve the best possible agreement. On 25 May 1973, the government exercised its option to acquire five per cent of Petronord. This holding was transferred to the newly-established state oil company Statoil. Later, Hydro also exercised its double option to increase its share from 13.6 per cent to 32.87.

Although Elf retained the operatorship, the Norwegian position had become significantly stronger. Licence interests were now 27.61 per cent for Elf, 32.87 per cent for Hydro, 20.71 per cent for Total Marine Norge, 13.81 per cent for Aquitaine and five per cent for Statoil.

Britain’s TOM group comprised Total Oil Marine (UK) Ltd as operator with 33.33 per cent, Elf Oil Exploration & Production Ltd with 44.45 per cent and Aquitaine Oil (UK) Ltd with 22.22 per cent.

One of the Norwegian government’s trump cards in the fight over a unitisation agreement was the median line treaty of 1965 with the UK. This specified that the governments of the two countries should seek to reach agreement on how structures which lay in both continental shelf sectors could be most effectively exploited and the revenues distributed. The governments were ultimately responsible for ensuring the best possible utilisation in socio-economic terms. True, they could not force the companies to unitise – but if the two nations were agreed it would be difficult for the licensees to oppose them.

A step forward

The various parties had made some progress by the end of 1972. Hydro and the Norwegian government dropped their demand for a parallel development, while the French companies agreed to joint production. Agreement was reached that production would start at different times, but would aim for maximum effective utilisation.

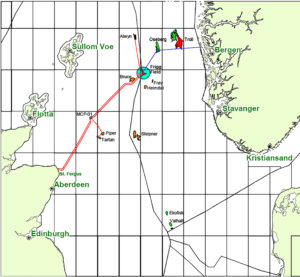

A processing plant was to be built at St Fergus in Scotland to receive the British gas through a pipeline from Frigg. Petronord would receive a percentage of the revenues when production began from the UK side.

That meant money in the bank for Petronord, significantly reducing the consortium’s need to borrow for funding its own development. In addition, the Norwegian authorities gained time to complete discussions on another key issue for a Frigg development – namely, where the Norwegian gas was to be landed. We will return to that question.

Licensee groups reach agreement

The biggest hurdles in the negotiations between Petronord, the TOM group and the Norwegian and British government related to efforts to find a way to divide up the reservoir between the two countries. A lot of money was at stake. Calculations indicated that each one per cent share would correspond to two billion standard cubic metres (scm) of gas. Assuming a price of NOK 0.05 per scm, that would be worth NOK 100 million. The sales price actually turned out to be six times higher.

By the summer of 1972, the question of a division of the field had become a red-hot issue. The Frigg reservoir had been calculated in January to contain 285 billion scm of gas, with 57 per cent lying in the Norwegian sector. Then Total drilled a dry well on the UK side. The Norwegian players maintained that this called for a reassessment of the size and division of the field to Norway’s advantage. On 8 September, both sides presented their overall estimate of reservoir size and division: Elf/Total maintained that the field contained 260 billion scm, with 52-55 per cent lying on the Norwegian side, while Hydro argued that reserves totalled 234-291 billion scm. Of this, 65-66 per cent was Norway’s.

To reach agreement, Elf proposed the engagement of independent experts who could interpret the data and draw a conclusion. The other parties concurred with this proposal. The choice lay between DeGolyer and MacNaughton and Core Laboratories, and the former was selected. Its assignment was first to determine the extent of the Frigg reservoir, second to estimate the total volume of gas and finally to calculate how large a share fell on each side of the boundary. This work was due to be completed by 30 September 1974. While the licensees undertook to accept DeGolyer and MacNaughton’s conclusions, the British and Norwegian governments refused to be bound by them. The deal to hire expert consultants was enshrined in the Frigg field expert agreement, the first official contract between the partners in the licences, at the end of May 1973.

DeGolyer and MacNaughton took its time in reaching a conclusion. Before these findings were ready, three other agreements had been concluded between the two sets of licensees.

On 9 July 1974, the Frigg main agreement determined that the field would be treated as a single unit and that the ultimate shares of the various participants would be determined by their original interest and the cross-boundary division of the reservoir.

The Frigg operating agreement was signed on the same day. This established the guidelines for developing the field and organising the actual gas production. It also contained provisions on how certain operations should be carried out and a binding structure for communication between the companies and the authorities. A division of the Frigg operatorship was agreed, with Elf responsible for developing and operating the whole field. Total took charge of the transport side, which involved both laying and operating the pipelines and operating the receiving terminal.

Finally, a transport agreement was signed between Petronord and the TOM group. A key issue in the unitisation process had been where the Norwegian share of Frigg’s gas should be landed and who would purchase it. This proved a difficult part of the negotiations. Total was bound by the British law which said that all gas production from the UK continental shelf must be offered to the British Gas Corporation (BGC) as the state distribution monopoly. This made it clear that at least one pipeline had to be laid from Frigg to the UK to carry the British share of the gas.

In Norway, the political intention was that petroleum production should be landed wholly or partly in the country if the national interest required it. This was made clear in the royal decree of 9 April 1965. But landing in Norway faced a number of problems. First, selling the volume of gas involved to the domestic market would be difficult. Norway was not a large gas consumer, and no distribution network existed. Second, crossing the deepwater Norwegian Trench between Frigg and the Norwegian Coast was not technologically feasible at that time. A unitisation agreement which covered both development and production of Frigg required an exemption from the Norwegian landing rule.

After a long and complex political process, Petronord concluded a gas sales contract with the BGC on 1 July 1974. A royal decree of 21 June 1974 gave the green light to landing and selling the Norwegian Frigg gas in the UK. The Frigg transport agreement between the TOM group and Petronord was signed nine days later. This involved laying two pipelines from the field to St Fergus, one British and the other Norwegian, with Total UK as operator for both.

Governments decide

These four deals – the main, operator, expert and transport agreements – concluded the unitisation work carried out by the licensees. It was now up to the Norwegian and British governments to agree a formal treaty. Although the basis for this had been laid by the agreements between the licensees, the discussions dragged on. There were several reasons for this, including the fact that the size and division of Frigg were still not clear. In addition, Statfjord had been found further to the north. This huge oil field also straddled the boundary, and it was important for Norway that a thorough job was done with the Frigg unitisation in order to provide a starting point for negotiations over Statfjord.

The final Frigg treaty was signed in London during May 1976. Its terms by and large confirmed the agreements reached between the licensees. The Frigg reservoir was defined to embrace the main structure and associated gas-containing strata. Procedures were also developed for determining later disputes over the division of interests. The number of platforms and their location were specified. The licensees were required to draw up a plan to ensure acceptable production of the field, which would be revised once a year. It was determined that no barriers should be imposed to prevent free movement of personnel and freight over the boundary. Common safety measures and regulations were to be developed. Two separate pipelines would be laid and the field would have two operators, one for production and the other for transport. This treaty opened the way to commercial exploitation of Frigg.

Approaching a clarification

Although the unitisation deal was in place, disagreement on the size and division of Frigg remained unclarified. It was clear as early as the summer of 1973 that DeGolyer and MacNaughton needed more data before it could reach a conclusion, and that more seismic would have to be shot.

At the same time, the newly-formed Norwegian Petroleum Directorate wanted an independent opinion on the field. It hired Core Laboratories to review data on the reservoir’s size and to advise on certain engineering problems relating to the formation and its production in connection with the proposed unitisation. Core concluded that Frigg contained 242 billion scm of gas, with 69 per cent lying on the NCS.

Hydro and Statoil disagreed over the interpretation of the seismic data which was submitted, and a big divergence existed between DeGolyer and MacNaughton’s interpretations and those made by the Norwegian companies and not least by Core. DeGolyer and MacNaughton had concluded that only 51 per cent of the gas reserves were on the NCS. The French companies had to admit that uncertainty over the interpretation was great, but were satisfied with the result.

Hydro and Statoil called for new drilling in order to reach more reliable conclusions. The Norwegian companies had everything to gain from additional appraisal wells, even though their cost was high – an estimated NOK 20 million each. DeGolyer and MacNaughton agreed in September 1974 that a new well on the western flank would be sensible. Statoil and Hydro convinced the French companies that three more were required. All four wells were drilled between April 1975 and January 1976.

Almost three years late, on 14 February 1977, DeGolyer and MacNaughton signed off its final report on the size of the gas reserves in Frigg and their allocation between the UK and Norway. The reservoir was estimated to contain 268 658 million scm, of which 60.82 per cent belonged to Norway and 39.18 to the UK. Although the licensees had undertaken to accept these conclusions, the Norwegian and British authorities were free to reject them. After much discussion, however, both governments accepted the division of reserves on 12 December 1977. By that time, parts of the field were already developed and production had started from the UK side.[REMOVE]Fotnote: This text is based on an unpublished manuscript by Lars Gaute Jøssang and Birger Lindanger, Pioner på sokkelen. Elf i Norge gjennom 30 år 1962-1992, and on Gunnar Nerheim, En prøvestein på petroleumshushold og unitisering, Norsk Oljemuseums årbok, 1991.

Unitisation in Norwegian

The term unitisere (unitisation) has been established as an unambiguous concept in the Norwegian oil industry, meaning “to treat as a single unit”. It was accepted by the Norwegian Language Council in 1991, which had no objections to its continued use if the term was established in the industry. However, the council noted that there was nothing wrong with using a more “Norwegianised” term, such as enhetsbehandle/enhetsbehandling. Letter from the Norwegian Language Council to the Norwegian Petroleum Museum, 21 November 1991.